The Credit Stress Report 2022 Q4 is out

The Credit Stress Report 2022 Q3 is out

June 22, 2023

The Credit Stress Report 2023 Q1 is out

June 22, 2023

Q4 highlights the continuing and increasing appetite for credit, despite continued inflation and rising interest rates

Eighty20 and XDS Credit Bureau have partnered to bring you the quarterly Credit Stress Report.

This quarterly report highlights the impact of economic forces on the South African consumer, with a particular focus on consumer credit behaviour. Q4 highlights the continuing and increasing appetite for credit, despite continued inflation and rising interest rates.

This report highlights that while retail figures suggest some respite in the storm that has been battering South Africa recently, newly in default rates tell a very different story. We look at macro trends in credit and the impact on four Eighty20 National Segmentation (ENS) consumer segments that make up 78% of all credit active South Africans and 92% of all loan value. These segments are Students and Scholars, the Mass Credit Market, Middle Class Workers, and the Heavy Hitters.

There were more than 800 000 new entrants into the Credit market this quarter, the highest since Covid, but it has come with a surging number of loans, notably credit card, VAF and home loans, that are newly in default.

12% surge in credit card balances

Total defaulters are down 2% and total overdue balances are down 11% from quarter four 2021. This is largely driven by significant write-offs of olds loans (particularly VAF) over the last year. Overall, there was strong demand for new credit with 800 000 new entrants to the credit market in quarter four, compared to 600 000 in the previous year. These new entrants took out R9.3bn in new loan value, the highest in more than 2 years, and up nearly 10% on last year. There has also been a significant surge in credit card balances with total loan balances up R25bn (12%) YoY. This brings the total credit active population to 18.7m with total loans balances of R2.3 trillion.

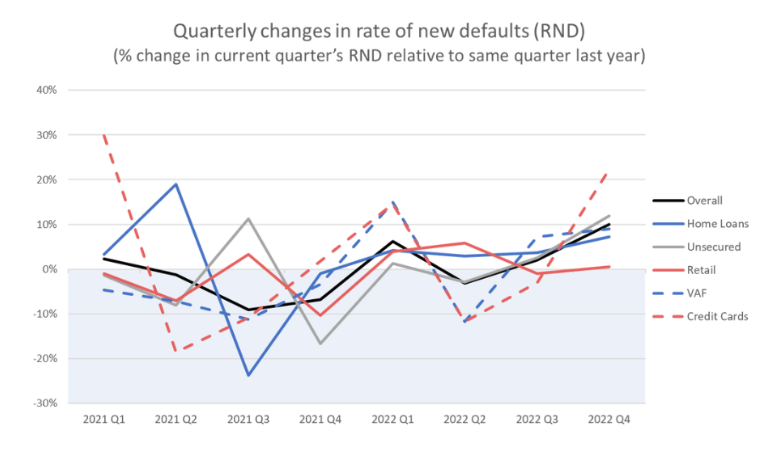

Despite this healthy growth, it is the Rate of New Defaults (RND), the proportion of current loan balances that went into default during the quarter, that is particularly worrying – sitting at 2.2%, up by nearly 16% compared with this time last year. This sharp increase in the RND year-on-year is driven primarily by credit card, home loans and VAF loans with increases of 20%, 19% and 18% respectively (compared to -0.3%, 10% and 5% in quarter three). The RND is an early warning indicator of the state of credit stress amongst South African consumers.